step 1. The financial institution Isn’t The Lending company

When you take out a home loan, car loan, or any other style of collateral financing, you’re contractually forced to conform to what’s needed. Once you signal the fresh data files, these are typically delivered to a 3rd-cluster merchant rented because of the lender to track their mortgage portfolios. You do not see a few things about your home loan.

- Consumers aren’t clients – loan providers is, and you will guarantee loans were little more than merchandise, which have development quotas and value-per-financing servicing agreements trumping the requirements of brand new borrower.

- Mortgage servicers make the most of foreclosures – the bucks originates from the newest borrowers and you can bodies.

- Regulation isn’t as strict whilst seems – loan servicers ready yourself account prior to people regulating see.

- There is no Corporate Work environment – when a customer support agent sends a demand to your corporate workplace, its addressed in identical strengthening.

I understand this since the We did during the one of the one or two financing payday loan Brighton trackers servicing more than ninety % of your security financing about U.S. I was a functions director, best several organizations, supervising tactics, keeping database, and you will composing processes and functions used by individuals upkeep their funds.

In the us, the fresh new lender in fact capital a home mortgage isn’t actually the fresh new lender (Pursue, Wells Fargo, etcetera.) about vast majority from circumstances. The lending company merely will act as that loan servicer, and also the real individual try either the latest You.S. government, courtesy Fannie mae, Freddie Mac computer (compliment of an enthusiastic FHFA conservatorship), the fresh new Va, FHA, plus, otherwise from the individual people using mortgage-recognized ties.

Once the financing servicers, these types of financial institutions try to be your face of your own guarantee funds, and because on the, anyone is used to simply writing about these middlemen because the loan providers.

If you’d like to refer to a lender since your financial lender, relate to the newest eleven bodies-paid finance companies bringing exchangeability to help with property money the new Federal Financial Banks (also known as FHLBanks).

2. You’re brand new Product, Perhaps not the customer

Of the supplier-visitors matchmaking between financing servicers and you will loan providers, the brand new homeowner does not basis toward picture. The mortgage tracker’s buyers is the financing servicer, additionally the financing servicer’s client is the lender.

The security loan is absolutely nothing more a valuable asset, and also the service contracts (the help of its relevant Services Top Arrangements) influence the fresh maintenance of the mortgage over your actually ever you will definitely.

The government ultimately establishes just what requirements need to be adhered to of the financing features, therefore you might be better off appealing to your neighborhood congressman than the regional lender rep if you are up against a foreclosures or repossession.

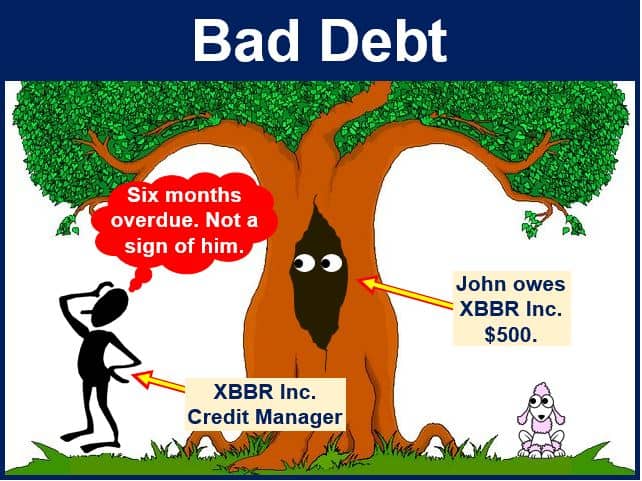

3. Finance companies Earn more money For individuals who Default

Loan servicers get money in order to provider the borrowed funds, no matter whether or not the latest debtor will pay. In fact, is in reality best providers in the event the borrowers standard when that loan non-payments, a whole lot more servicing is needed, and the servicer renders extra cash.

If the servicer protects a foreclosure (which is once again did from the a third-class vender), the loan tracker places exclusive genuine-estate-owned (REO) insurance on the possessions, which costs 10x over normal home insurance.

Of many mortgage loans in the U.S. are appeal-simply fund, in which repayments into the basic five to help you 10 years dont apply to the main equilibrium. REO insurance policies became prolific because many people due more the home worthy of shortly after taking right out appeal-simply loans.

By foreclosing for the possessions, the lender are able to flip the house and also other renter paying for they, if you are however holding the foreclosed borrower guilty of the identity.

So it crams numerous mortgage loans towards same schedule together with enhanced fees revolving up to foreclosure maximize Return on your investment to have dealers from the possessions, who would’ve achieved merely 4 percent roughly in the event the just one borrower paid back promptly.

4. Regulators Cautioned All of us In advance of Surprise Visits

Being employed as a procedures manager, I was will a part of place of work tours from possible loan servicing subscribers and you can regulators, none of who ever saw an entire image.

The fresh new shortest see i actually got of just one of those trips is actually two days, and middle management caused it to be important which will make an effective trip, guaranteeing records is made and you can tasks are left into the queues so you can give a seamless experience toward website visitors.

Maybe not two days once learning of your own difficulties the members have been going right through, they sent all their strewn data to our offices in check to locate them off of the properties before authorities came in so you can audit them.

Although we was in fact susceptible to regulation of the FEMA for ton zoning points during the Hurricane Katrina, the new FHFA, the fresh New york Service out of Monetary Properties, and many more federal and state government, ultimately no one try watching what we performed they only saw everything we showed them.

5. The corporate Work environment Try a myth

Although as that loan tracker, I experienced the capability to affect your own escrow account, loan updates, and just about every other information about their loan’s record, I had zero outside range that will be attained because of the consumers. The sole time I made use of a telephone for outside communications try to speak to the corporate readers.

On the flip side, the customer provider agencies your called for loan servicers visited our phone call stores where customer support agents understood by themselves just like the agents off whatever financial you believed is your own bank.

I were not resting in a few ivory tower indeed, i worked within the cubicles proper close to each other, you you’ll never ever keep in touch with me personally. Alternatively you’re told their consult had been sent in order to corporate, that would make devotion.

Really don’t regret my big date employed in the fresh new loans industry. Including the average person, I did not know anything from the mortgages, insurance, otherwise financial going into my job. I read along the way and finally realized I was an excellent an element of the disease.